According to a recent study of 10,000 millionaires, three things millionaires have in common are they set clear money goals, make a budget and consistently stick to their budgets.

In fact, the vast majority of millionaires budget every month and 93% of them stick to the budgets they make.

Millionaires have made a habit of actively managing their money. These people know exactly where their money is going before it’s ever spent.

”Rather than wondering where their money went at the end of each month, millionaires tell their money where to go at the beginning of the month.”

In contrast, according to a recent U.S. Bank study, only 41% of Americans said they use a budget. Since that number includes millionaires, the percentage of non-millionaire Americans who use a budget is much lower than 41%.

What’s the takeaway? If you want to become a millionaire, then you need to set money goals, create a personal budget and stick to it!

”Manage your money; don’t let your money manage you.”

If you’re ready to learn how to make a personal budget in excel just like the millionaires do, then keep reading now!

Create a personal budget in excel and stick to it

In order to create a budget, you need a budget template. And, a spreadsheet is best because you can use it to automate a lot of calculations to save you time and headaches.

You could create your own from scratch. But, why waste your time trying to recreate the wheel?

Download this free personal budget template and you’ll save a ton of time and get features the millionaires use for their budgets.

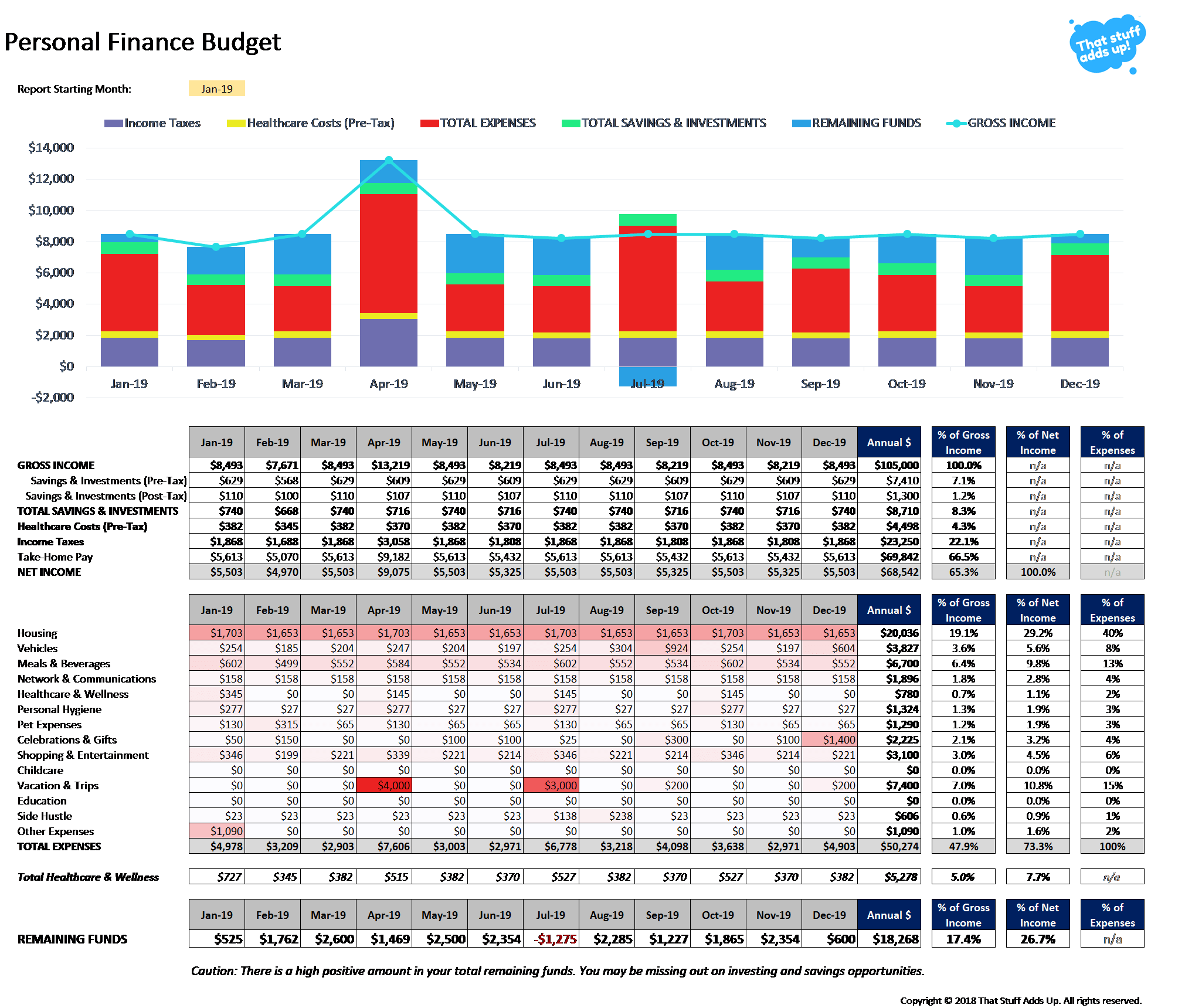

Below is a screenshot of the one-page personal budget summary report for reference.

Throughout this article, I’ll reference sections of the free budget spreadsheet so it’ll be easier to follow along if you have a copy.

Once you have your budget spreadsheet, you’ll want to follow these six steps to create your personal budget and stick to it:

- Document your current income

- Document your recent spending and expenses

- Analyze your situation to understand where your money is currently going

- Set money goals and update your budget to reflect them

- Make immediate changes and adjust your behaviors to stick to your budget

- Track your spending and monitor your progress monthly

With that, let’s dive into each of these six steps where I’ll show you how to complete each one!

Document your current income

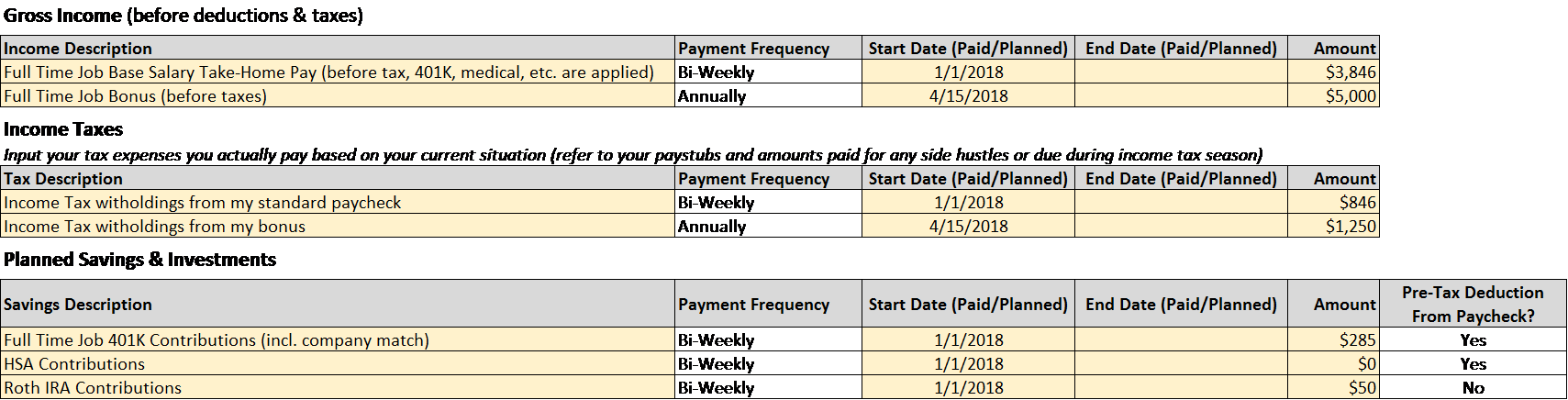

The first thing you’ll want to do is obtain all of your income information and add it to your budget template.

If you’re employed with a company, I recommend obtaining your pay stubs from the last two months. These will tell you the amount of your gross income before taxes or any other deductions are subtracted, such as medical premiums.

Your pay stub will also highlight your income taxes, contributions to your company-sponsored retirement and health savings accounts, as well as, all medical, pharmacy, dental and vision premium costs you pay. Last but not least, it will state your take-home pay.

Don’t forget to obtain information on any bonuses you receive throughout the year. I recommend obtaining your past pay stubs when your bonus was paid so you can understand how they’re paid and taxed.

If your partner or spouse is employed and you both share personal finances, then make sure you obtain their information too.

Finally, obtain details for any other income you receive, such as consulting on the side, waiting tables, driving for Uber and so on.

Once you have the details for all of your income items, you need to enter them into your budget and sum them up to calculate your total income by month.

I understand how tedious this can be, especially when each item gets paid on a different date and with different frequencies (weekly, bi-weekly, monthly, etc.).

Knowing this, I created the free personal budget template to do all of the hard work for you!

All you have to do is list the items with their payment dates, frequencies and dollar amounts, and voilà, everything is calculated and summarized in a monthly report instantly!

Refer to the screenshots below to get a feel for the income input list and the summarized income section.

Income input section screenshot:

Income summary report screenshot:

Document your recent spending and expenses

The next thing you need to do is document all of your expenses and spending habits.

Once you know how much you spend on each expense category, I want you to enter these amounts, on average, in your budget spreadsheet. The importance of doing this is that it allows you to see where your money has been going and can be very eye-opening.

So, how do you quickly pull your recent expenses?

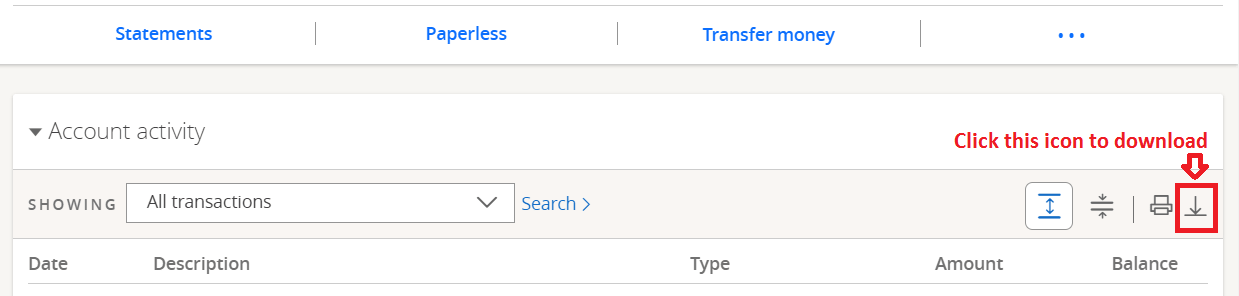

Thankfully, due to online banking and credit card statements, you should be able to pull 99% of your expenses and spending using your online accounts.

For example, I have a checking account and credit cards with Chase Bank. Using my online account, I can download the last 24 months of checking account statements in Excel. And, I can download the last 7 months of credit card spending details in Excel.

See screenshots below for how to do this using Chase Bank. If you use other banks, such as Bank of America, Wells Fargo, Citi Bank, American Express, and so on, then they should have the same features.

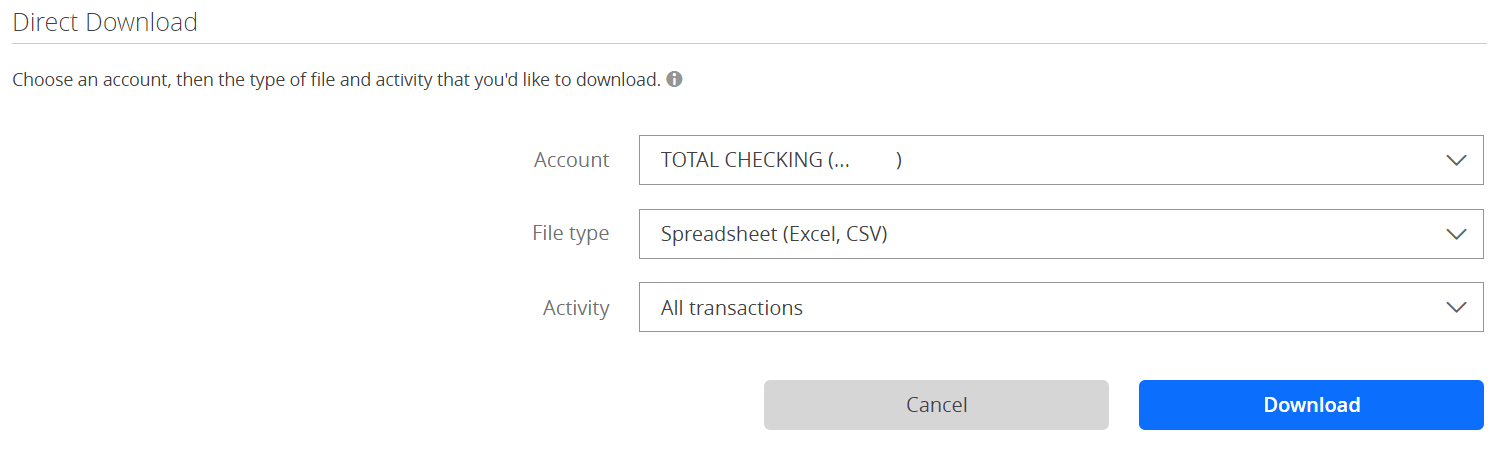

How to download Chase Bank checking account details to Excel:

Step 1: Initiate download

Step 2: Set criteria for download

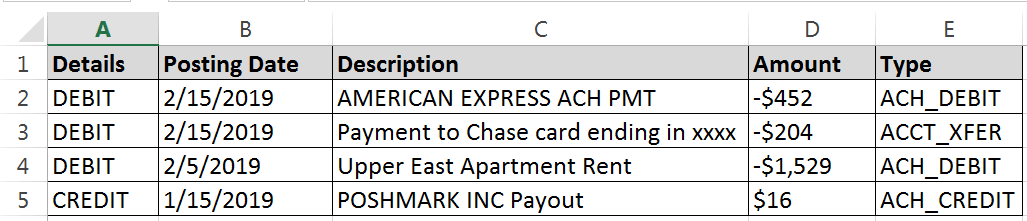

Step 3: View your checking account export details

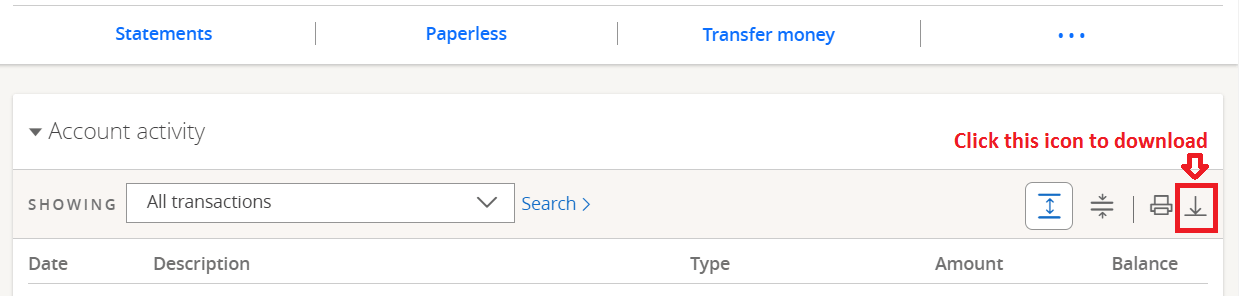

How to download Chase credit card details to Excel:

Step 1: Initiate download

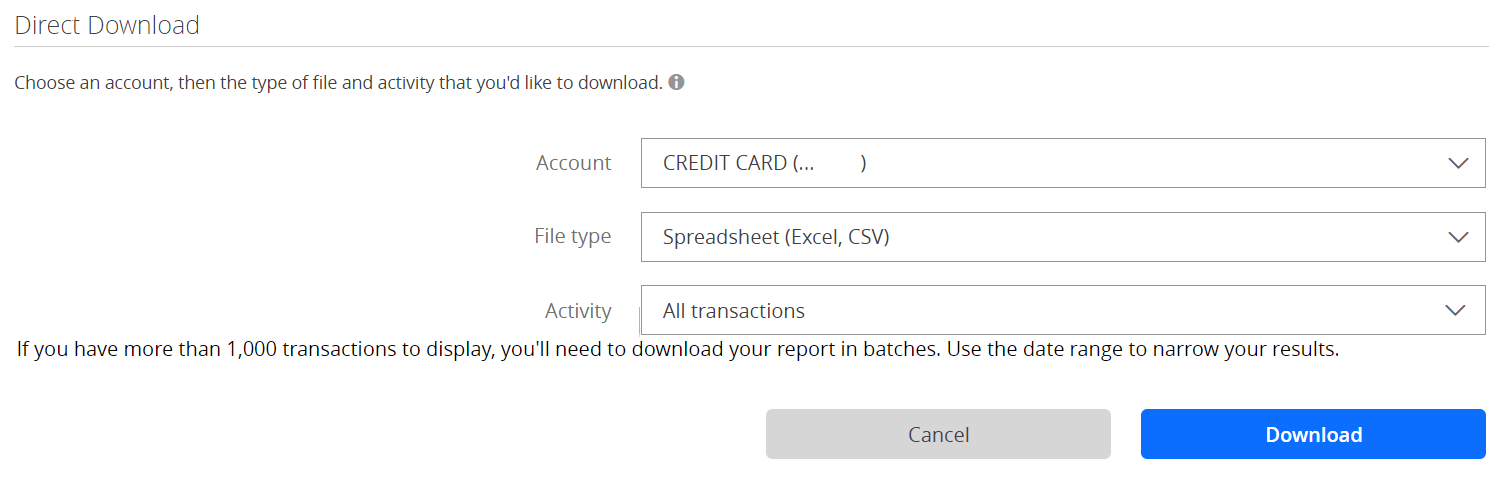

Step 2: Set criteria for download

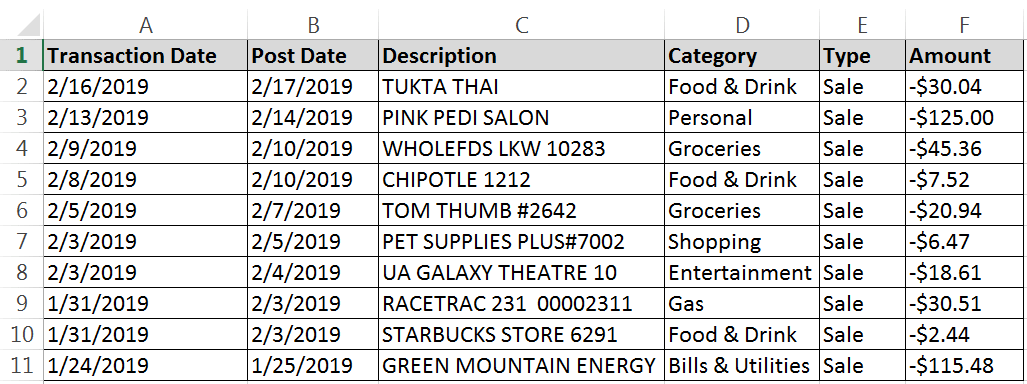

Step 3: View your credit card download details:

Organize your expenses and spending details & add them to your budget template

Now, after you’ve downloaded all of your checking account, savings account and credit card details into Excel, I recommend copying all the data into one spreadsheet.

You’ll need to standardize the columns so the dates, expense names, categories, and amounts are all in the same columns. By doing this, you’ll have all spending and expense data on one sheet that you can reference and work from.

Next, add a column to your data for the expense category that you want to add to the budget spreadsheet. For example, I would label Starbucks, Restaurants, and drinks out as “Meals: Eating Out”. I would also label Wholefoods and Tom Thumb as “Meals: Groceries”.

This allows you to standardize the expense type across all stores you shop at, which helps you calculate your average monthly spending for budgeting purposes.

Next, you can create a pivot table to sum your spending by month and category so you can calculate your average spending per month per category. This will make it much easier for you to transfer this information to your personal budget spreadsheet.

If you don’t know how to create a pivot table, you can simply sort your data by most recent date, then sum the category amounts by month. Then, you can average those amounts.

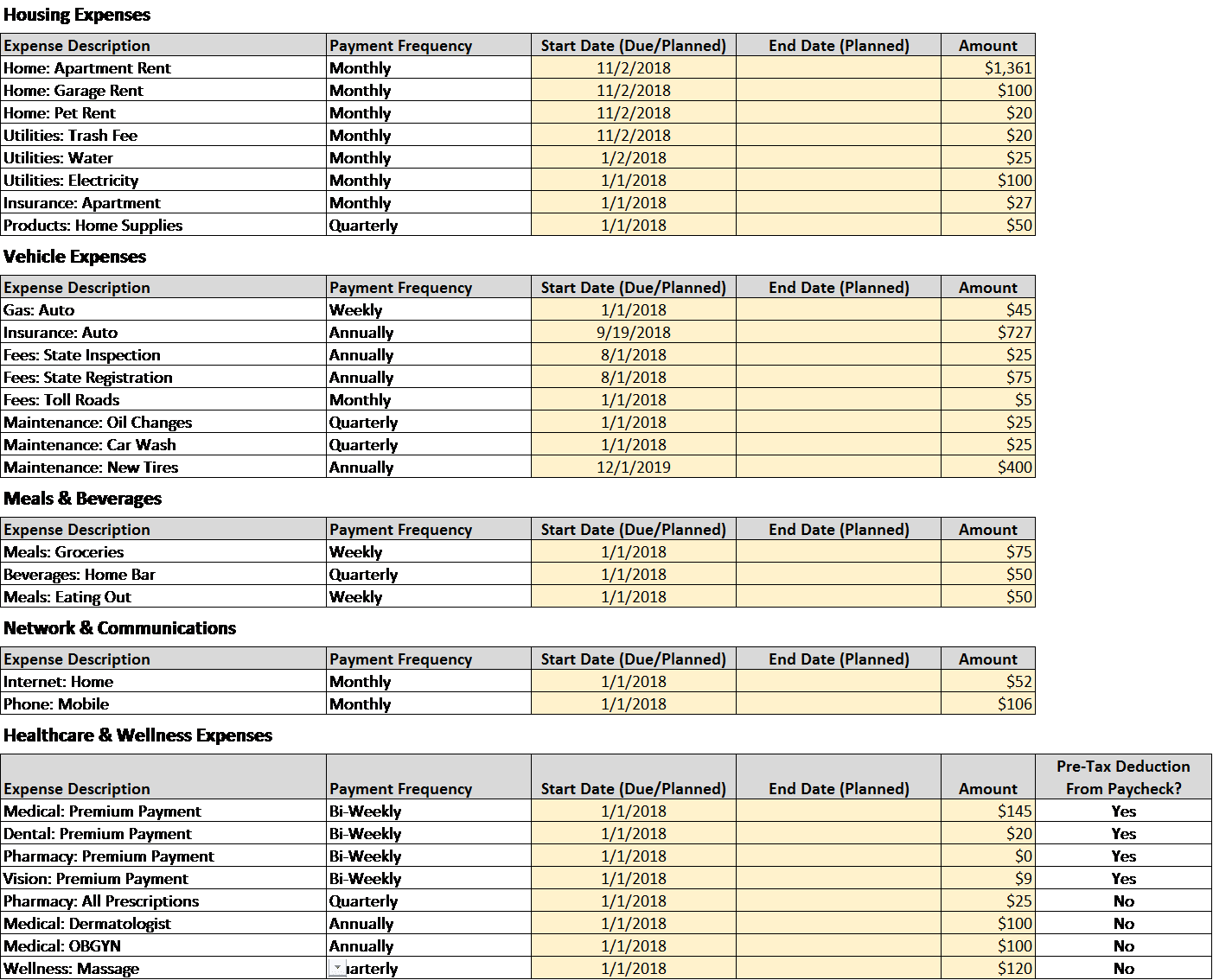

Below is an example of what your inputs to the budget spreadsheet template should look like.

Expense input section screenshot:

Please note, the start date can be either date in 2018 or in the future. The end date should be empty unless you know of an expense that is temporary (e.g. 3 month subscription starting and ending on specific dates).

Also, if your medical, dental, pharmacy and vision insurance is provided through your employer, then you can find your cost of those on your pay stub.

There’s also a drop-down for you to state which healthcare & wellness expenses are deducted from your gross income before taxes are applied.

Make sure you add all of your known expenses throughout the year and the date they occur. For example, this can include credit card annual fees, oil changes, car registration, vacations, and more.

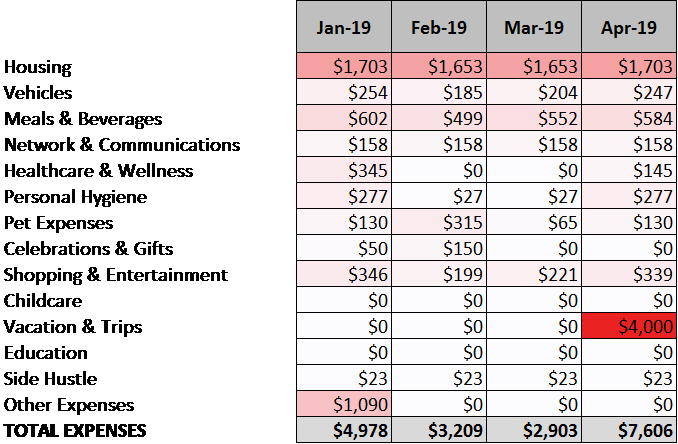

Expense summary report screenshot:

Once you have all of your expense details in the expense input section of the budget, all calculations will automatically be calculated and summarized in your personal budget report.

I’m an Excel nerd, so this makes me happy! I hope you enjoy these features and that they save you a ton of time and frustration.

Refer to the screenshot below to get a feel for what the expense summary report looks like.

The report has built-in conditional formatting to visually represent which expenses are the highest relative to all expenses. The largest expenses are highlighted in a red fill color.

Analyze your situation to understand where your money is currently going

Now the fun part begins!

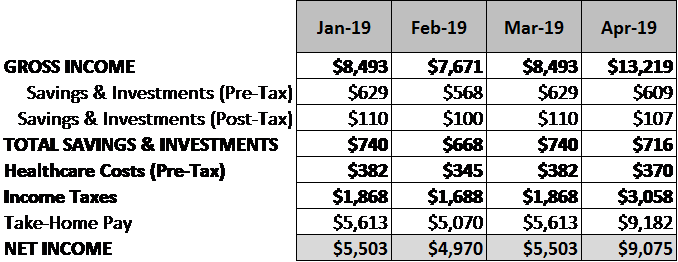

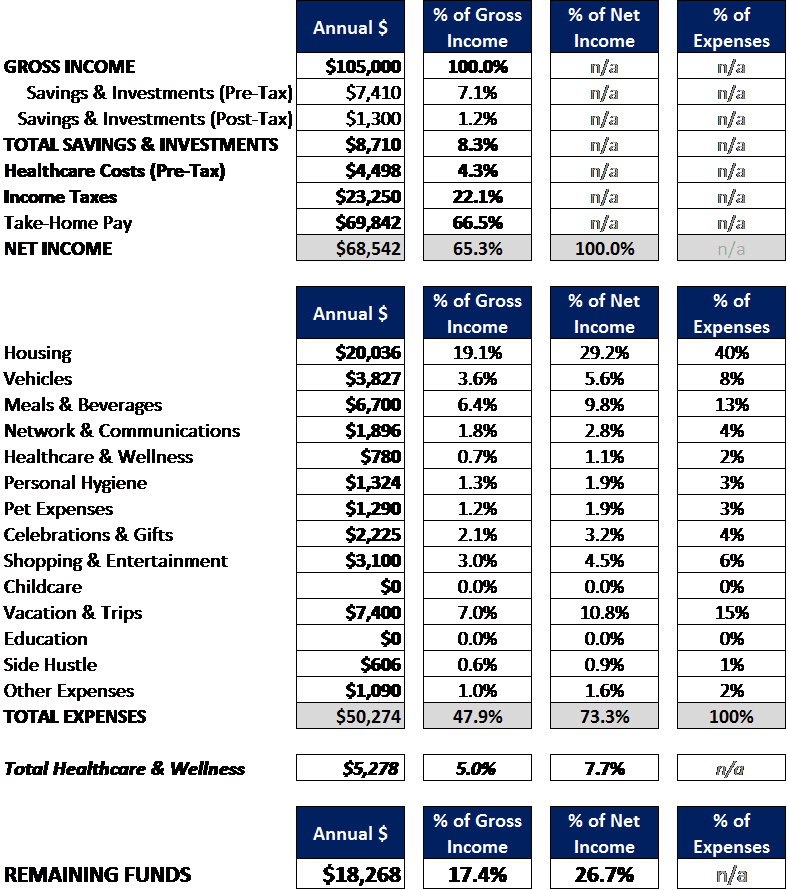

Once you’ve gone through the tedious process of documenting all of your income and spending details, the budget spreadsheet will automatically produce your summary report.

This allows you to view and understand the big picture of what is going on with your money.

It helps you know how much is coming in throughout the year by month and how much is going to expenses by category, savings and investments.

I built the personal budget spreadsheet to help you analyze some important key metrics. Those metrics show how much each item is as a (1) percentage of Gross Income (pre-tax earnings), (2) percentage of Net Income (take-home pay minus post-tax savings & investments), and (3) percentage of total expenses.

These metrics will help you understand how much of your budget each item is taking up. Ideally, you want the highest percentages in your investments and savings. And, you want your expenses to have the lowest percentages!

Below is a screenshot of these metrics for your budget year.

Full personal budget summary report screenshot:

Spend some time analyzing your personal financial summary report to understand where you can cut back on spending, then move to the next step.

Set money goals and update your budget to reflect them

Now that you understand what’s currently happening with your money, the real budgeting can begin.

This step is where you’ll set money goals and update your personal budget to reflect them.

In my last post titled “Retire early by using these four proven financial levers”, I outlined many ways you can save over $10,000 per year by pulling four financial levers.

Those levers are to (1) decrease your expenses, eliminate bad debt to free up cash, (3) increase your income and (4) optimize your investments. And, under each lever, I give you many examples to save money.

During this process of setting money goals and building your budget, you’ll have to evaluate what matters to you and make decisions for where your money will go.

For example, if you have a goal to pay off your student loans quicker or invest 15% of your income, then set that goal for yourself. Go into your income and expense input sections and update those numbers. Then, determine where you can cut back on other spending to hit your goals.

Can you decrease your eating out budget or shopping budget to hit your primary goals? If so, decrease your spending budget for those items.

Repeat this process until you’re happy with where every one of your dollars is going.

Your goal is to make sure there’s zero dollars in the “Remaining Funds” line on the summary budget report, which is how much money is leftover each month after paying for expenses, investing and saving. This is called zero-based budgeting.

If you have any extra money remaining each month, you need to put that money to work for you!

Please do not let it just sit in your checking account. Use it to pay off your high-interest debt and allocate it to your retirement investments and high-yield savings accounts.

As I mentioned before, this is you controlling your money and telling it what to do each month rather than wondering where it went at the end of the month.

You got this!

A common roadblock some people have is not knowing where to allocate their money.

If you’re stuck on where and how to allocate your money, then answer the following questions for guidance.

”Am I allocating my money to the things that bring me joy in life?”

”Does my spending and allocation reflect my values and what’s important to me?”

These questions help you understand what’s important in your life and ensures you get the most out of every dollar in your life.

For example, let’s say your report shows that you’re spending more on alcohol and cigarettes than you are on a gym membership and eating healthy. This is basically showing that you value unhealthy behaviors more than you do your personal health.

Now, I love a good cocktail or glass of wine. So, I’m not trying to tell you what to do. I’m just trying to help you determine how to align your money allocation to what you truly value.

Also, let’s say your report highlights that you’re barely saving and investing for your retirement, but your shopping and eating out costs are really high. That’s saying that you value short-term satisfying activities than you do your long-term financial security.

Is that what you truly value? And, does every dollar you spend on eating out and shopping improve your happiness and joy in life? If not, change your financial goals and update your budget.

You don’t have to completely eliminate your eating out and shopping budget. Ideally, you want to optimize it so you’re spending the minimum necessary on those things that still bring you joy, without going overboard.

This is basically you understanding and applying the Law of Diminishing Marginal Utility.

Finally, one thing I want to call out is that you should always aim to minimize bad debt. What’s bad debt? Things that are not backed by appreciating assets.

As a result, bad debt is any debt that is not backed by an asset (e.g. credit card debt) or is backed by a depreciating asset (e.g. vehicle).

If you’re paying credit card interest expense and fees each month, then allocate funds to pay off that debt ASAP. And, if your vehicle expenses are one of the largest expenses in your budget, then please re-evaluate your vehicle and driving choices.

Once you’ve updated your budget template to include all of your income, spending, saving and investing goals, then move to the next step.

Make immediate changes and adjust your behaviors to stick to your budget

Now that you’ve built your ideal budget to hit your goals, it’s time to start implementing changes so you actually achieve your goals.

The first thing I recommend is automating any payments that are not currently automated. The purpose of this is to ensure you avoid any late fees or interest payments on credit cards. If you’ve been accidentally paying these, then that’s hard earned money down the drain.

In addition to automating payments, you should automate your investments and savings! This includes setting up automatic contributions to your 401K or other retirement accounts. And, automating savings to your health savings account (HSA) and/or high-yield savings account.

The next thing to do is cancel any unnecessary subscriptions and/or services you have that are working against your budget.

For example, this could include cancelling that Birchbox or Spotify subscription. It could also mean cutting the cord on your high cost cable subscription and converting to Roku and/or Netflix.

The third thing I recommend is finding alternative, less expensive services. For example, you could save a lot of money by switching your cell phone service provider, auto insurance and internet provider.

After you’ve completed these, which I consider the quick wins, you may have a few more changes to make. These could include downsizing your housing situation and/or selling your current vehicle and getting a less expensive, used vehicle.

For example, we recently saved $800 per month by downsizing our home. That’s $9,600 per year in savings that we put towards early retirement investments!

The last thing is to create new habits to hit your money goals that you set for yourself. These include things like cooking at home more instead of eating out all the time. Or, avoiding impulse purchases.

The point of all this is to put your budget plan in action. You’ll never hit your money goals if you do not make changes in real life. Be intentional with your money.

Track your spending and monitor your progress monthly

Finally, we’re at our last step of budgeting. This is the step where you should track and monitor your progress monthly to determine if you’re hitting your goals.

If you don’t do this step, then you’re at risk of not knowing how you’re actually progressing. You know what they say…”What gets measured, gets done”.

There are two ways you can measure your progress monthly.

One is to setup a separate spreadsheet in Excel or Google Sheets where you can type your expenses every day by category. By doing this, you’re tracking everything as you go and don’t have to do any “catch-up” work at the end of the month.

Plus, if you use Google Sheets, then you can open your spreadsheet on your mobile phone and add expenses immediately after spending.

The second approach is to spend using your credit cards and checking account and download the details in a spreadsheet from your bank(s). This is similar to the step above where you downloaded your bank spending details.

Once you have all of your actual spending, savings and investments tracked and in a spreadsheet, you can then compare them to your monthly budget.

If you came in under budget, congratulations! If not, then try to find a way to make up for it during the next month.

By making this a habit, you’ll be well on your way to early retirement and becoming one of those everyday American millionaires!

This is something you can achieve. It just takes a little planning and intentional living.

Create and stick to your budget to become a millionaire

In summary, the six steps to building a millionaire personal budget are:

- Document your current income

- Document your recent spending and expenses

- Analyze your situation to understand where your money is currently going

- Set money goals and update your budget to reflect them

- Make immediate changes and adjust your behaviors to stick to your budget

- Track your spending and monitor your progress monthly

Now is the time to set you and your family up for financial security and success.