The early retirement movement is on FIRE in 2019. Every day there’s a new article posted online about financial independence and early retirement, also known as FIRE.

According to the Social Security Administration, the normal retirement age in the U.S. is 67 years old. Using that definition, we can define the age of early retirement as 66 years old or younger.

Unfortunately, the sad truth is that the vast majority of Americans will never be able to retire early, let alone retire by the age of 67.

If you’ve read my previous post titled “Early Retirement: How much money do you really need?”, then you know you need more than $1M to safely retire.

Based on my research using the 2016 U.S. Federal Reserve Survey of Consumer Finances, only 52% of families have retirement accounts. And, the median value of retirement accounts for those families is only $60,000.

Breaking that down further, only 59% of people ages 55 to 64 have retirement accounts. And, their median retirement account value is only $120,000. These people probably thought they’d be able to retire early too. Now, they’re facing the reality that they may never achieve a safe retirement.

So, are you truly confident you’ll be able to retire early? If so, how long will it take you to achieve your early retirement number?

If you’re not sure if you’ll be able to retire early or how long it will take you, don’t worry. Throughout this post, I’ll help you answer those questions. And, if you’re not on track to retire early, I’ll show you how to get you back on track.

Luckily, if you’re under the age of 50, it’s still possible for you to achieve early retirement! Follow along to learn how.

How to determine your early retirement age and what you can do to speed it up

In this post, I give you the tools you need to determine how long it will take you to retire early. And, if you want to speed that date up, I show you what levers to pull to make it happen. Keep reading below to learn how by following these 3 easy steps:

- Calculate your early retirement age based on your current financial situation and habits

- Learn what financial levers to pull to speed up your retirement

- Determine your ideal early retirement age and how you’ll achieve it

Calculate your early retirement age based on your current financial situation and habits

This first step is critical because it shows you the financial path you’re currently on. I like to think of it as your retirement wake-up call. Who knows, you may be happy with the financial path you’re on. Or, not… Let’s find out!

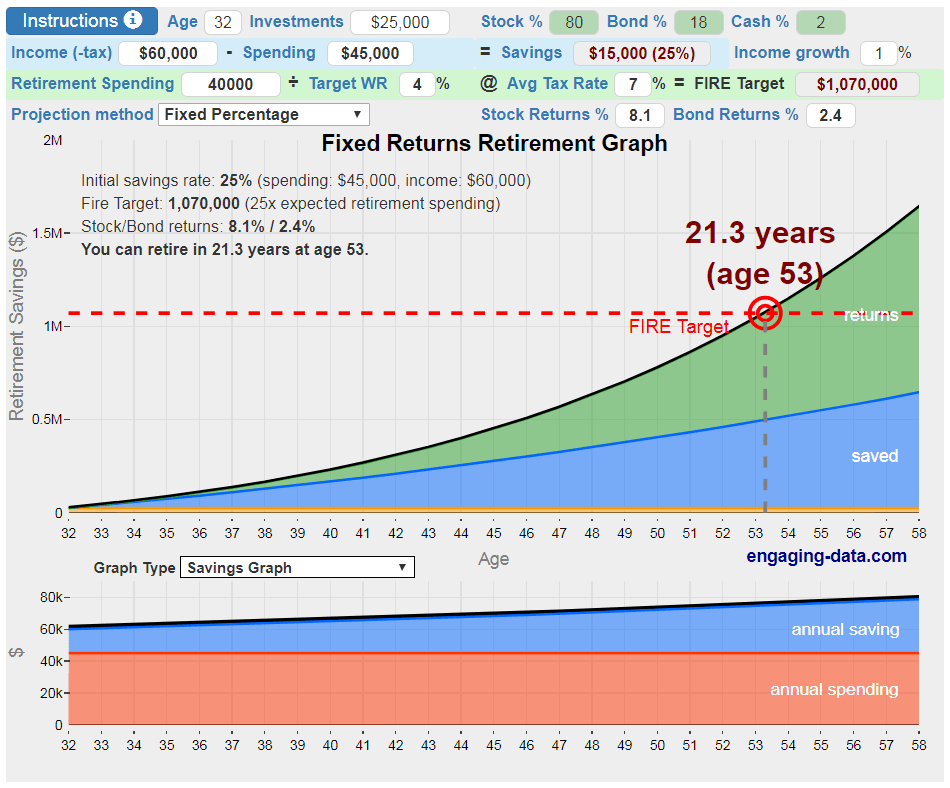

Calculating your early retirement age is fairly easy thanks to this Early Retirement Calculator.

All you need are a few key inputs and the calculator will return your retirement age and the number of years it will take for you to retire.

Listed below are the Early Retirement Calculator inputs you’ll need

Age: This is your current age.

Investments: This is the sum of all of your investments and savings. You should include your cash, checking & savings account balances, retirement account balances (e.g. 401K, IRA) and any other investments, such as Index Funds, Individual Stocks, CDs and Bonds.

Next, you’ll have to obtain the percentage of these total investments that are allocated to stocks, bonds and cash.

Stock %: This is the percentage of the total investments you have in stock related accounts, which include individual stocks, 401Ks, IRAs, index funds and mutual funds. Each of your investment accounts will list your allocation percentage to stocks. For example, you may have 90% of your 401K account in stocks and the remaining 10% of your 401K account in bonds.

Bond %: This is the percentage of the total investments you have in bonds, such as corporate bonds and government related bonds. Each of your investment accounts will list your allocation percentage to bonds. If you have savings accounts or CDs that earn more than 2.0% interest, then I recommend accounting for them under the Bond %.

Cash %: This is the percentage of your total investments (and savings) that you have in cash-like accounts. These include actual cash and your checking & savings accounts. If you have savings accounts or CDs that earn less than 2.0% interest, then I recommend accounting for them under the Cash %.

In order to calculate your total investments, stock %, bond % and cash %, you’ll need to obtain the current dollar value of all your investment and savings accounts. Then, identify the dollar amount of each that are allocated to stocks, bonds and cash using the information above.

Once you have that information, you can easily calculate the percentage allocated to each. The sum of these percentages should equal 100%. Refer to the table below for an example.

| Accounts | $ in Stocks | $ in Bonds | $ in Cash | Total $ |

| My 401K | $45,000 | $5,000 | n/a | $50,000 |

| Spouse’s 401K | $27,000 | $3,000 | n/a | $30,000 |

| Spouse’s IRA | $4,500 | $500 | n/a | $5,000 |

| Individual Stocks | $5,000 | n/a | n/a | $5,000 |

| Savings (2.20% APY) | n/a | $5,000 | $0 | $5,000 |

| Savings (0.10% APY) | n/a | $0 | $500 | $500 |

| Checking | n/a | n/a | $1,000 | $1,000 |

| Cash | n/a | n/a | $100 | $100 |

| Total Investments | $81,500 | $13,500 | $1,600 | $96,600 |

| Allocation % | 84.4% | 14.0% | 1.7% | 100.0% |

Income (-Tax): This is the total income you and your spouse earn annually. It should be your income minus your income related taxes. You will also need to leave your pre-tax savings (e.g. 401K, HSA) included in your income amount.

Spending: This is the total amount you spend annually while saving for retirement. It should include all of your expenses, including housing, transportation, food, clothes, entertainment and more. You should also include your health care costs, including your medical, dental and vision monthly premiums.

Savings: This is an output of your savings rate, which will be calculated for you based on your inputs. This amount will be allocated to your investments based on the stock %, bond % and cash % you enter.

Income Growth: This is the growth percentage you expect your income to increase each year while saving for retirement. For example, if you get a standard 2.0% raise each year, then that’s the growth rate you should enter.

Retirement Spending: This is the total amount of money you expect to spend each year in retirement (in current dollars). You should include the total cost of health insurance since you will not be employed and will have to pay the full amount in early retirement. If you currently have employer-sponsored health insurance, your employer likely covers 80% of your actual health insurance costs. You do not need to add income taxes in this field as they’re covered in another input field listed below. But, if you expect to have a home, you should include property taxes in this field.

Target WR: This is your safe withdrawal rate (SWR). The most common SWR is 4%. You can learn more about the SWR here.

Avg. Tax Rate: This is your expected average income tax rate each year during retirement. This is not the marginal tax rate. Retirement taxes are pretty complex and can vary based on your investment accounts (e.g. traditional vs Roth, ordinary income vs capital gains). Remember, your tax rate should be based on your annual retirement spending from above, which you’re expected to pay income taxes on after withdrawing your funds (unless you withdraw from a Roth account).

FIRE Target: This is an output of the retirement portfolio or amount of money you’ll need invested in order to retire. This is based on your retirement spending and withdrawal rate inputs from above.

Stock Returns: This is the average annual stock market return you estimate receiving from now through retirement.

Bond Returns: This is the average annual bond return you estimate receiving from now through retirement.

Now, go calculate your early retirement age!

Once you have all of your inputs, go to the Early Retirement Calculator, enter them and learn how long it will take you to retire.

Learn what financial levers to pull to speed up your retirement

So, how long will it take you to retire based on your current situation? Is it 25, 30, or 40 years?

If you cannot imagine working like you are now for the next 25 years or more, don’t worry. There are financial changes you can make to speed up your retirement date. I call these your financial levers.

Your most important financial levers are your income and spending. Other important financial levers that you can control are your total investments and your investment portfolio allocation, which is the percentage invested in stocks and the percentage invested in bonds.

There are many changes you can make right now to improve these financial levers for yourself.

For example, to increase your income, you can ask for a raise from your current employer or switch companies to get a higher raise. You could even start a side hustle, such as easily teaching kids English online. Seriously, you can earn $14-$22/hour teaching English in your spare time with VIP Kids!

To decrease your spending, you can move into a cheaper apartment, cook at home more rather than eating out, and buy groceries & home products a Costco. You can even save money by switching your cable, internet, phone and auto insurance providers.

To increase your investments, take your extra cash flow from increasing your income and decreasing your spending and put it into your retirement accounts. If you have an employer-sponsored 401K with a match, then max that puppy out! Your investments work for you. The more you have, the more they’ll grow (even when you’re sleeping).

Regarding your investment portfolio allocation, you’ll gain higher returns by investing more of your money in stocks. Yes, they’re riskier than bonds or cash, but bonds and cash provide very little returns. So, you’ll have to take some risks. But, you can minimize your stock investment risks by investing in diverse stock funds that track the broad stock market indexes.

The most commonly recommended stock fund in the early retirement community is Vanguard’s total stock market index fund (VTSAX). From 2009 to 2019, VTSAX turned $10,000 into $41,086. That’s a 4.1x increase in 10 years. Plus, VTSAX has one of the lowest expense ratios!

Those are the four most important financial levers you need to focus on for right now. And, did you notice how these were the first inputs in the early retirement calculator? That’s because they’re important to your retirement success.

Since these financial levers are in the retirement calculator, you can easily run scenarios by changing them to see how much they’ll speed up your early retirement age!

Open up the early retirement calculator again and play with these inputs to see just how much they impact your retirement age. This will help you get a feel for what changes you can make to achieve early retirement sooner.

Determine your ideal early retirement age and how you’ll achieve it

Now that you have a good understanding of which financial levers impact your retirement success the most, I want you to set your early retirement goals. To do this, you need to be realistic while still pushing yourself.

The main goal I want you to set is your early retirement age. Then, I want you to set goals for each of your financial levers, which are how you’ll achieve your early retirement goal.

So, if your current retirement age without making any changes is 70 and your early retirement goal is 50 years old, then I want you to explicitly state what your financial levers will need to be. That means you’ll need to set your annual income, spending and investment goals.

Then, I want you to incorporate these goals into your personal budget. This is a very important habit to start because a budget serves as your guide to achieve your goals.

By tracking your actual finances compared to your budget, you can see if you’re on track or not. If not, then you have the information to make improvements quickly. You know what they say, measure what matters. If you don’t currently have a budget, then please create one ASAP.

You can get started today by downloading this free, automated personal budget template now!