It’s that time of year again! And, I’m not referring to the holidays. I’m referring to arguably one of the most important decisions you’ll make all year: choosing your health insurance plan.

But first, before we dive into how to choose your health insurance coverage go read my previous post How Health Insurance Works to get a quick refresher on the key terms. You’ll even find an easy to follow infographic showing a patient’s journey using health insurance.

Okay, now that you’ve been refreshed on the basic health insurance terms and how health insurance works, you have a solid foundation to make the best health insurance decision for you and your family!

Let’s dive in!

Follow the 5 easy steps below to choose the right health insurance plan for you and your family!

- Understand the types of health insurance plans available to you

- Find out if your providers are in-network

- Perform a cost analysis to understand your financial risk

- Compare the benefits of each health insurance plan

- Choose the health insurance plan that is right for you

Step 1: Understand the types of health insurance plans available to you

The first step is to get a basic understanding of the types of health insurance plans. If your employer offers health coverage as a benefit, then your options with them are usually limited to two types of plans.

The primary differences you’ll find between all plans are (1) whether or not referrals are required from a primary care doctor to see a specialist, (2) whether or not the insurer will cover a portion of out-of-network provider costs, and (3) the economics (i.e. premium costs, deductible amounts, out-of-pocket max, etc.).

The descriptions of all health insurance plans and the primary differences between them are outlined below.

High Deductible Health Plan (HDHP):

A HDHP is a health plan with a higher deductible than a traditional insurance plan. The monthly premium is usually lower, but you pay more health care costs yourself (i.e. your deductible) before the insurance company starts to pay its share. HDHPs may be a HMO, PPO, EPO, or POS health plan.

Under a HDHP, are you able to see a specialist without a referral?

This varies since HDHPs may take on characteristics of PPO, HMO, EPO or POS plans.

Are out-of-network providers covered under a HDHP?

This varies since HDHPs may take on characteristics of PPO, HMO, EPO or POS plans.

A HDHP may be right for you if:

1) You’re young and healthy.

2) You prefer lower monthly Premium costs in exchange for a higher Deductible.

Consumer Driven Health Plan (CDHP):

Description:

A CDHP is a type of high deductible health plan that is combined with a tax-preferred healthcare account, such as a Health Savings Account (HSA), allowing you to pay for qualified medical expenses with money free from federal taxes. This type of plan is intended to make patients act more like consumers by making more informed decisions to minimize their costs.

Under a CDHP, are you able to see a specialist without a referral?

This varies since CDHPs may take on characteristics of PPO, HMO, EPO or POS plans.

Are out-of-network providers covered under a CDHP?

This varies since CDHPs may take on characteristics of PPO, HMO, EPO or POS plans.

A CDHP may be right for you if:

1) You’re young and healthy.

2) You prefer lower monthly Premium costs in exchange for a higher Deductible.

3) You want to maximize tax savings by using an HSA.

Preferred Provider Organization (PPO):

Description:

A PPO is a type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Under a PPO, are you able to see a specialist without a referral?

Yes.

Are out-of-network providers covered under a PPO?

Yes, but out-of-network providers are more expensive than in-network providers.

A PPO may be right for you if:

1) You don’t want required referrals to see a specialist.

2) You want more provider options.

3) You want a lower Deductible with higher monthly Premiums.

Health Maintenance Organization (HMO):

Description:

A HMO is a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

Under a HMO, are you able to see a specialist without a referral?

No.

Are out-of-network providers covered under a HMO?

No, except for emergencies.

A HMO may be right for you if:

1) You want a primary care doctor who will coordinate your care for you, including referring you to specialists.

2) You don’t mind a smaller provider network with little choice.

3) You want lowest out-of-pocket costs and no or a low Deductible.

Point of Service (POS):

Description:

A POS is a type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

Under a POS, are you able to see a specialist without a referral?

No.

Are out-of-network providers covered under a POS?

Yes, but out-of-network providers are more expensive than in-network providers.

A POS may be right for you if:

1) You want a primary care doctor who will coordinate your care for you, including referring you to specialists.

2) You want a larger provider network with more choice.

3) You want lower out-of-pocket costs and no or a low Deductible.

Exclusive Provider Organization (EPO):

Description:

An EPO is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

Under an EPO, are you able to see a specialist without a referral?

Yes.

Are out-of-network providers covered under an EPO?

No, except for emergencies.

An EPO may be right for you if:

1) You don’t want required referrals to see a specialist.

2) You don’t mind a smaller provider network with little choice.

3) You want lower out-of-pocket costs and no or a low Deductible.

Which health plans are the most common?

As of 2018, according to the Kaiser Family Foundation’s 2018 Employer Health Benefits Survey, the most common health insurance plan among covered employees is the PPO, which covers 49% of covered workers. The second most common is the HDHP/CDHP, which is utilized by 29% of employees. The HDHP/CDHP is also the fastest growing health insurance plan among the insured having increased to 29% in 2018 from 4% in 2006. The PPO and HDHP/CDHP are followed in popularity by HMOs (16%) and POS plans (6%).

Given this information, if you’re employed there’s an 80% chance your employer offers you a PPO and/or a HDHP/CDHP. Therefore, you’ll want to make sure you understand the difference between those types of plans.

Now, if you’re self-employed or your employer does not provide employer sponsored health insurance, then you may want to become familiar with all of your health insurance options from the healthcare exchanges or eHealth Insurance.

In summary, you can narrow your plan types down to at least two options using the above table and based on what’s available to you through your employer.

Step 2: Find out if your provider is in-network

The next step you need to do is find out if your preferred providers are considered in-network under your prioritized health insurance options.

The risk for you is choosing a health plan where your preferred providers and local hospital are considered out-of-network. This is inconvenient and causes you to either stop using those providers or continue using them, but pay way more out of your own pocket.

Most, if not all, health insurers have a search tool on their website where you can see which providers are in-network vs out-of-network. If you cannot find the online tool, then call the insurance company and they will answer your questions.

You’ll want to make a list of the primary care doctors, specialists and hospitals that (a) you’ve visited in the last three years that you want to continue having access to and (b) you may need to visit in the next year.

For example, if you’re planning to have a baby within the next 12 months, then figure out which hospital and doctors you want to take care of you during pregnancy and delivery. Then, see if they are in-network with your health insurance options.

Once you know which providers and hospitals are covered under each plan, you can make a more informed decision. If your preferred providers are considered out-of-network, then you’ll need to determine if that’s a deal breaker for you or not.

Many people are okay switching providers if necessary to save costs. But, this is ultimately a personal decision for you and your family. At the end of the day, just make sure you have plenty of high quality, in-network options within a 30 minute drive of where you live.

Step 3: Perform a cost analysis to understand your financial risk

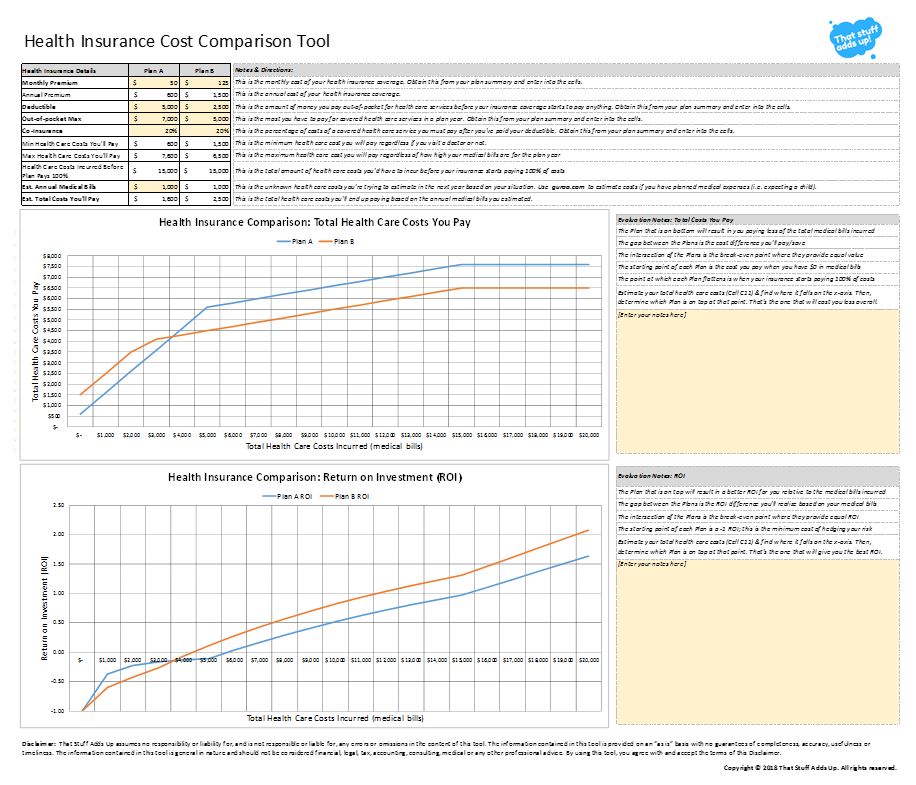

Moving on, the third step you should take is to perform a cost and ROI analysis between your final health insurance options. This doesn’t have to be a complex financial analysis.

At a minimum, I recommend the following:

- Calculate your Minimum Total Cost: This will be your total annual Premium payments. It’s the minimum because you pay these costs even if you never see a doctor. It’s your cost of coverage.

- Calculate your Maximum Total Cost: This will be your total annual Premium payments plus the plan’s Out-of-Pocket Maximum (OOPM). It’s the max you’ll pay since insurance covers 100% of your covered health care costs after you’ve hit your OOPM. Your OOPM does not include your Premium payments, which is why you add them together.

- Estimate your health care usage next year: This is the unknown factor and risk you’re trying to manage. I recommend using Guroo to estimate the total cost of health care services you may use next year. For example, you can find estimates for the cost of having a baby or appendectomy.

- Calculate your Estimated Total Cost: Using the estimated usage from item 3 above, calculate what your total cost would be under each health plan option, including premiums, deductibles, co-insurance, etc. The results will show a clear winner based on your estimates and you’ll know where your estimated total costs fall within each plan’s Minimum & Maximum Total Cost.

Even if you don’t feel comfortable estimating your health care usage next year, you can determine which minimum and maximum range you’d be okay paying if you have bad health luck next year.

If you don’t want to worry about all the math, then I highly recommend you download our Free Health Insurance Cost Comparison Tool to easily evaluate your personal financial impact.

All you have to do is plug in a few key inputs and everything updates automatically, giving you a complete financial picture to make a wise decision. You’ll get a clear visual comparison between the plans and ROI calculations! Below is a screenshot of the tool.

Please, let me know what you think!

Step 4: Compare the benefits of each health insurance plan

The final step before choosing your health insurance plan is to make sure you understand what benefits each plan provides. By “benefits”, I’m referring to what types of health care services are covered.

Under U.S. laws, you have the right to an easy-to-understand summary about a health plan’s benefits and coverage. This is known as the health plan’s Summary of Benefits and Coverage (SBC).

The SBC is provided by the insurance company and provides you with a short, plain language summary of the coverage and benefits along with a uniform glossary of terms used. In addition, insurers are required by law to show how the plan would cover two common medical scenarios: childbirth and diabetes care. This information helps you make an apples-to-apples comparison between plans.

You can view a sample SBC here and view a sample Glossary of Health Coverage here.

You’ll need to determine what coverage benefits are most important to you and see how each plan covers them. To get you started, below are some of the most common coverage items people look into:

- Are Pre-existing Conditions covered?

- What Preventive Services are covered?

- What Behavioral Health (i.e. Mental Health & Substance Abuse – includes counseling) services are covered?

- What’s the plan’s Maternity (i.e. Pregnancy, Childbirth & Birth Control) coverage benefits?

- Is there coverage while traveling domestically and/or abroad?

- How is Physical Therapy covered?

- How are Prescription Drugs covered?

- What are the Pediatric coverage benefits?

- What health care services are considered “Excluded Services”?

As you can imagine, this step is very personal to you and your family and is not a one size fits all. Therefore, you need to ensure you have the coverage for what matters most to you and your family.

Step 5: Choose the health insurance plan that is right for you

Okay, this is it! Now, you’re ready to make your final decision on which health insurance plan to choose.

I recommend you outline your criteria in terms of what matters most to you and your family.

For example, let’s say I put more weight on the costs I’ll pay and Plan A is expected to cost me $1,000 less than Plan B over the year. Plan A’s benefits coverage is slightly worse than Plan B, but not enough to sway my decision. Therefore, I would choose Plan A.

Once you know what matters most, then your decision should be very clear.

In summary, these are the 5 easy steps on how to choose a health insurance plan that is right for you.

- Understand the types of health insurance plans available to you

- Find out if your providers are in-network

- Perform a cost analysis to understand your financial risk

- Compare the benefits of each health insurance plan

- Choose the health insurance plan that is right for you

If you have any other recommendations, please let us know in the comments below. Also, don’t forget to download our Free Health Insurance Cost Comparison tool using this link!

I liked how the article said that you should outline insurance criteria in terms of what matters most to you and your family. My brother just got married and he has been deciding on what insurance to get for him and his wife. It may be good for him to consult with a professional health insurance company to figure out what the best plan for them would be.

Thanks, Dean!

I’m glad you enjoyed my article on how to choose health insurance. Also, good point; many people should advise a professional if they’re not confident in navigating the U.S. health insurance market.

It’s good to know that if you choose a health insurance company that considers your preferred provider out-of-network, you can end up paying more money out of pocket. My sister is looking for new health insurance because she is planning on leaving her job next month. I will be sure to recommend she investigate and find an insurance company that services her providers so that she doesn’t have to change doctors.

Thank you for your comment, Brad. Best of luck to your sister in finding a good health plan! She could keep her existing plan under COBRA, but it will likely be too expensive since her employer may cover the majority of premium costs while employed. The next best option will likely be to find coverage on the ACA health exchange.