In my last post, I gave you the tools to determine how much money you really need to retire early.

Knowing the amount of money we need for financial freedom gives us an ultimate financial goal to work towards. It tells us where we want to go.

But, we also need to understand where we’re starting from if we want to reach our destination.

So, today I’m going to focus on helping you understand your current financial position, which is Step 3 of the Financial Freedom Framework.

This step is important because it tells you exactly what is happening with your money today. It also gives you the insight needed to ensure you’re on the right track.

Make sure to read the last section where I give you key tips based on your financial position.

How to evaluate your current financial position

Your financial position can be evaluated using two simple numbers: your net worth and your personal cash flow.

Once you know your net worth and cash flow, you can analyze them to determine if you’re in a good or bad financial position.

You can also compare them to your early retirement number to understand how long it will take you to achieve financial freedom. Think of it this way:

“Your early retirement number is your destination and your current net worth is your starting point. Your cash flow is the vehicle that will take you to your destination.”

Follow along to learn how to properly evaluate your net worth and personal cash flow.

Determine your net worth

Your net worth is your wealth. It’s the sum of your personal assets minus the sum of your liabilities.

Your assets are things you own. Examples include cash, savings and checking accounts, retirement accounts, home equity and vehicles.

Your liabilities are what you owe to others. Examples of these include your mortgage, vehicle loans, student loans and credit card debt.

If your net worth is positive, you own more than you owe. If your net worth is negative, you owe more than you own. You want your net worth to be a high positive number. In fact, that “high positive” number is your early retirement number!

The goal for your net worth is to have most of it in investments that work for you, such as retirement accounts. Depending on your situation and age, you’ll want more in your savings or bonds.

In order to properly evaluate your personal finances, you need to calculate your net worth. You can calculate your net worth by adding up all of your liabilities and subtracting them from all of your assets.

Net Worth = Assets – Liabilities

Refer to this article to learn more about calculating your net worth.

Understand your personal cash flows

Your personal cash flow is the sum of your income minus the sum of your spending. It’s money in minus money out.

Cash Flow = Income – Spending

You want your cash flow to be a high positive number. That means you have more money entering your accounts instead of leaving your accounts.

If you have a negative cash flow, then that means you’re losing more money than you’re bringing in. If that’s the case, then you’re not able to invest or save for early retirement.

Positive cash flow is very important, but it’s also important to put your extra cash to work for you. What I mean by this is you should be investing your positive cash flow in your retirement accounts, which grow over time. And, if you’re in debt with high interest rate loans, then you should use your positive cash flow to eliminate your debt burden.

Your cash flow will either increase or decrease your net worth. You can increase your net worth by funneling cash flow into assets or paying down your debt. On the flip side, you’ll decrease your net worth if you’re spending more than you’re saving or investing.

Refer to this article to learn more about calculating your personal cash flow.

Analyze your current financial situation

Now that you have a refresher on net worth and cash flow, calculate your current net worth and annual cash flow to see where you stand.

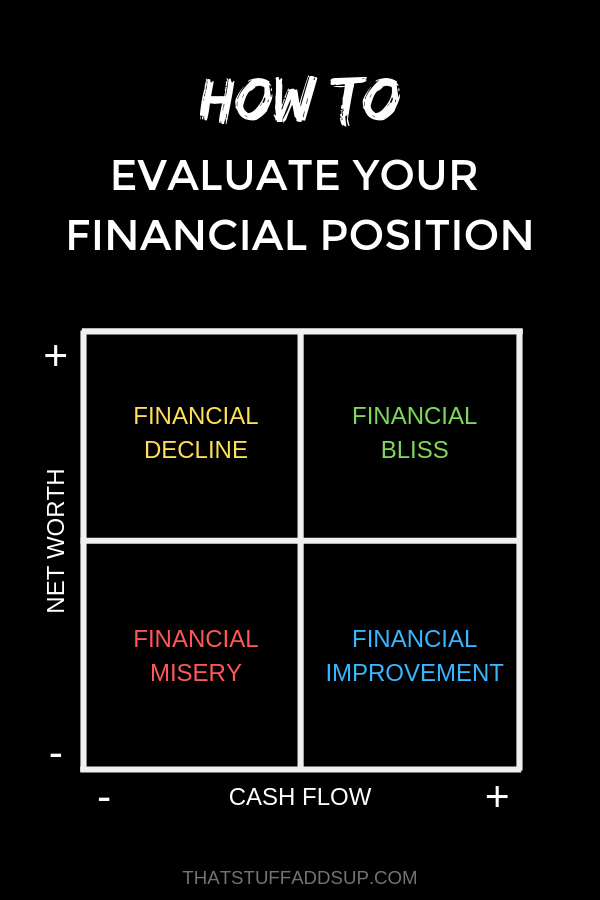

Once you have your numbers, find your financial position using the matrix below. Your position is based on a positive or negative net worth and positive or negative annual cash flows.

If your net worth is negative and your annual cash flow is negative, you’re in a state of financial misery.

If your net worth is negative and your annual cash flow is positive, you’re in a state of financial improvement!

If your net worth is positive and your annual cash flow is negative, you’re in a state of financial decline.

If your net worth is positive and your annual cash flow is positive, you’re in a state of financial bliss!

Refer to the sections below for an explanation of each of the financial positions and key tips that you should be focused on during each position.

Financial Misery

What is it?

Financial Misery means you have more debt than assets and you’re getting deeper into debt since your cash flow is negative.

People in this position are either in poverty or on their way to poverty.

Key tips if you’re in this position:

- Decrease your spending

- Increase your income

- Seek financial assistance

- Consider placing loans in deferment or forbearance

Financial Improvement

What is it?

Financial Improvement means you have more debt than assets, but you’re able to increase your net worth since your cash flow is positive.

People in this position are often lower income or earn a good income, but tackling a lot of debt such as student loans.

Key tips if you’re in this position:

- Build your emergency fund savings

- Increase your retirement investments

- Eliminate high-interest debt

Financial Decline

What is it?

Financial Decline means you have more assets than debt, but you are at risk of losing your wealth since your cash flow is negative.

People in this position typically fall into two categories. They are often retirees who are slowly depleting their nest egg. Or, they are in the middle class and either experiencing hardships (e.g. lost job, medical bills) or not spending their money wisely.

Key tips if you’re in this position:

- Decrease your spending

- Increase your income

- Preserve your wealth

Financial Bliss

What is it?

Financial Bliss means you have more assets than debt and you’re able to increase your wealth since your cash flow is positive.

People in this position typically fall into two categories. They are either middle class and in the accumulation phase of building wealth or they are in the upper class already.

Key tips if you’re in this position:

- Grow your wealth

- Increase your retirement investments

- Eliminate all debt

What financial position are you in?

To sum things up, you can find your financial position by calculating your net worth and personal cash flow. Then, you can evaluate your position using the above matrix.

So, what financial position are you in? I’d love to hear your thoughts!

Sign-up for my e-newsletter below to be notified as soon as new posts are released!